Recent Share Price Action

Since the high of 18.80, albeit a brief nudge for one trade at that price, Frontier's share price fell back down to previous resistance levels of 1350.

This was due partly because, as in previous years, Frontier have released a game every other year. As such there is a contraction in revenue and profits every other year. It has been two years since Planet Coaster was released, as such the year just passed will see a reduction in income compared to the year Planet Coaster was released. However Frontier have announced numerous times that they plan to release one game per year, thus alleviating this two year cycle.

Investors new to the company, who do not know much about the games industry, and who haven't done their research will look at the bottom line of the figures, think the company is not doing so well, and so sell. Not taking into account the coming transformative year of growth on the horizon.

The wait for the announcement of the fourth franchise, which was originally said to be announced alongside Jurassic World Evolution launch but which will now come at a later date, will also have factored into this. Braben has said that the announcement will come at the "best time." It seems that they are awaiting for the moment of greatest impact. We know this is another IP with a global fan base. It may be that they are waiting for a film release of the same license or something similar to create maximum impact.

There was also a short position opened by BennBridge LTD on May 30th for 0.5%. The share price at the time was circa 1760. Whilst a minimal short position and nothing to pay too much attention to, it was still a selling off of around 193,300 shares, which with a small float and on a more illiquid market, has a greater impact. This would have provided greater momentum for the fall back down to 1350.

Along the way, and during the few days that the share price hovered at around 1350, there was some unusual selling activity. When any large bid stack developed, against very little ask pressure, someone would undercut the sell price and sell immediately to all the bids thus eliminating the immediate bid pressure and lowering the share price. This happened numerous times throughout each day, usually towards the end of the day in order to subdue the marked share price at close.

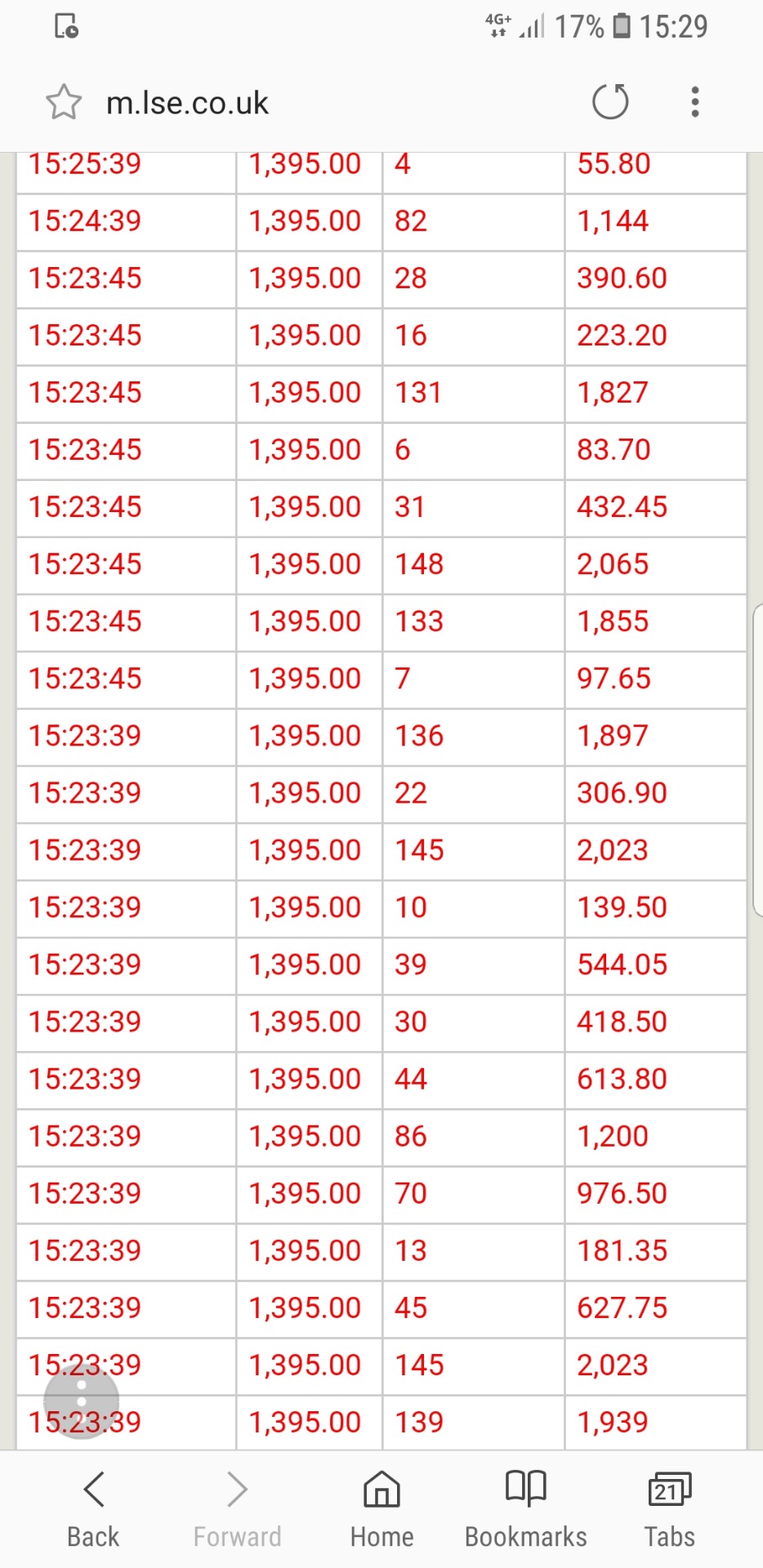

As an example. On 02/07/2018 at 15:23:39, 13 trades took place at the bid depsite on level 2 it being stacked 22 v 1.

Above that you can see another chunk of trades going through to eliminate the stack once more. This happened to an even greater extent earlier where 21 simultaneous trades took out the stack. I didn't manage to get a picture of that event.

What this suggests to me is that someone had been trying to subdue the share price. Not only by keeping it down, but by keeping the marked share price low for the end of trading despite reaching much higher during the early hours.

You can see by this graph that the past couple of days have seen a much higher sp than at close:

If the share price was marked at the peaks of the early hours, we would see a different daily graph.

It's a good strategy to make it look like the sp is going nowhere far. For example, if you said that the 24 hour period where the sp was logged for the day was around 11am, the sp would look like it was rising in quite a healthy way, with dips during the day before a rise back up to close. Instead what we see is a rise in the day and a fall towards the end, thus having the marked sp going from low to low, rather than high to high.

Having people think the share price is going down, up, down is better if you want to keep it low, than if people think it goes up, down, up. In reality it's the same thing. But psychology plays heavily on stocks and traders know this.

After

the Trading Update this morning (03/07/2018), Frontier announced for

the second time that revenue was ahead of expectations. This helped

stimulate an upward trend despite the previous days behaviours. We

shall see what happens from here but with revenue looking to beat all

market expectations it would be fair to rise to the previous highs

and beyond.